Analyzing U.S. Exceptionalism and Emerging Market Currency Challenges: A Comprehensive Review

In the dynamic world of global finance, the interplay between interest rate differentials, growth trajectories, and tariff impacts forms a complex mosaic. The recent discourse centers on U.S. exceptionalism and its ramifications on emerging market currencies, particularly the Mexican peso and the euro. This article delves into these intricate relationships, offering an in-depth analysis of their implications for global markets.

Table of Contents

The Driving Forces: Equity Performance, Growth Outperformance, and Rate Differentials

The performance of equity markets and growth differentials significantly influence currency values. In the context of U.S. exceptionalism, these factors are paramount. The U.S. has seen outperformance in equities and a steeper yield curve, leading to a higher terminal rate expectation. This environment, characterized by a robust equity market and a repriced Federal Reserve stance, sets the stage for bearish outcomes for emerging market currencies.

U.S. Exceptionalism: A Double-Edged Sword for Emerging Markets

U.S. exceptionalism implies that while the U.S. benefits from strong economic indicators, emerging market currencies suffer. The primary reasons include:

- Trade Uncertainty: The ongoing trade uncertainties, particularly with the U.S.-Mexico-Canada Agreement (USMCA), pose significant risks. The USMCA sunset clause in 2026 adds a layer of uncertainty, exacerbating the underperformance of carry trades involving the Mexican peso.

- Fed’s Terminal Rate: The anticipation of a higher terminal rate in the U.S. implies tighter monetary policy, which is detrimental to emerging markets. The markets are keenly watching the Fed’s actions, with expectations that any pause in rate hikes starting in December could still lead to a bearish outlook for these currencies.

- Political Uncertainty in Europe: The euro faces its own set of challenges with political instability, particularly in Germany. The potential collapse of the German government and upcoming elections add to the volatility, making the euro susceptible to further depreciation.

Risk Premiums and Trade Uncertainties: A Closer Look at the Mexican Peso

The Mexican peso is particularly vulnerable due to several factors:

- USMCA Clause: The 2026 sunset clause introduces long-term uncertainty, affecting investor confidence.

- Trade Relations with China: If the U.S. renegotiates trade standards or strikes a deal with China that sidelines Mexico, it could severely impact the Mexican economy.

- Trump’s Trade Policies: The possibility of renegotiating trade terms under Trump’s influence adds another layer of risk, potentially downgrading Mexico’s trade standing.

The Euro’s Predicament: Political Turbulence and Economic Challenges

The eurozone faces its own set of uncertainties, primarily driven by political instability in Germany. The potential collapse of the government and forthcoming elections could lead to significant volatility. Additionally, economic challenges within the eurozone, such as slower growth and inflationary pressures, further complicate the outlook for the euro.

U.S. Equity Markets and the Dollar: The Interplay of Market Dynamics

The strength of the U.S. equity market is a critical factor in the dollar’s performance. A robust equity market often translates to a stronger dollar, but this relationship can be complex. Here are some key considerations:

- Equity Market Sell-Off: A significant sell-off in equity markets could undermine the dollar’s strength. The ripple effects of such a sell-off would have profound implications for global markets, particularly emerging market currencies.

- Repricing the Fed: The market’s perception of the Fed’s future actions, particularly in terms of rate hikes or pauses, plays a crucial role in shaping currency dynamics. A higher terminal rate expectation leads to a stronger dollar, while any deviation from this path could weaken it.

Inflation and Fiscal Policies: Global Implications

The interplay between monetary policy, fiscal policy, and inflation is a global concern. Countries around the world are grappling with inflationary pressures while trying to stimulate growth through easier monetary and fiscal policies. This delicate balance presents significant challenges:

- Inflationary Pressures: With inflation already above target in many countries, the ability to stimulate growth without exacerbating inflation is limited.

- Bond Market Impact: The bond market’s response to these policies is critical. A significant impact on bond yields could influence equity markets, creating a complex feedback loop that affects global financial stability.

The Second Order Effects: Looking Ahead

As we look towards the future, several second-order effects could shape the financial landscape:

- Inflation as a Major Driver: Starting in 2025, inflation is expected to be a major market driver. The interplay between fiscal stimulus, monetary policy, and inflation will be crucial in determining market trajectories.

- Global Financial Conditions: The combination of easier monetary policies and fiscal policies globally will continue to impact financial conditions. The challenge will be managing these conditions without triggering runaway inflation.

FAQs

Q1: What is U.S. exceptionalism? A1: U.S. exceptionalism refers to the unique position of the U.S. in the global economy, characterized by outperformance in equity markets, stronger economic growth, and higher interest rates compared to other countries.

Q2: How does U.S. exceptionalism affect emerging market currencies? A2: U.S. exceptionalism tends to strengthen the dollar, making it more challenging for emerging market currencies to perform well. This is due to factors like higher interest rates in the U.S. attracting capital away from emerging markets.

Q3: What is the impact of the USMCA sunset clause on the Mexican peso? A3: The USMCA sunset clause introduces long-term uncertainty for trade relations, which can negatively impact investor confidence and lead to underperformance of the Mexican peso.

Q4: How does political instability in Germany affect the euro? A4: Political instability, such as the potential collapse of the German government, creates uncertainty and volatility, which can weaken the euro.

Q5: What are the second-order effects mentioned in the article? A5: Second-order effects refer to the indirect consequences of economic policies and market dynamics, such as the impact of inflation on long-term growth and financial stability.

Conclusion

The complex interplay of interest rate differentials, growth trajectories, and trade uncertainties forms a challenging environment for global markets. U.S. exceptionalism, characterized by strong equity performance and higher interest rates, presents significant hurdles for emerging market currencies. The Mexican peso and the euro, in particular, face unique challenges due to trade uncertainties and political instability, respectively. As we move forward, the global financial landscape will continue to be shaped by these dynamics, with inflation emerging as a critical factor in determining market outcomes.

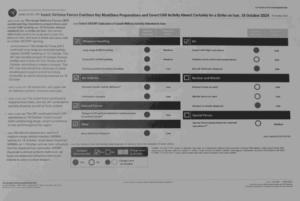

Table: Key Factors Influencing Emerging Market Currencies

| Factor | Impact on Emerging Markets |

|---|---|

| U.S. Interest Rate Differentials | Higher rates in the U.S. attract capital away from emerging markets, weakening their currencies. |

| Trade Uncertainty | Uncertainty in trade agreements like USMCA affects investor confidence and currency performance. |

| Political Instability | Political turbulence, such as in Germany, creates volatility and weakens currencies. |

| Inflationary Pressures | High inflation limits the ability of central banks to stimulate growth without exacerbating inflation. |

| Equity Market Performance | Robust equity markets in the U.S. strengthen the dollar, posing challenges for emerging market currencies. |

This comprehensive analysis provides a nuanced understanding of the current financial landscape, highlighting the critical factors and their implications for global markets. As we navigate this complex environment, staying informed and adaptable will be key to managing the risks and opportunities ahead.

Post Comment