Trump’s Tariff Plan: A Double-Edged Sword for the American Economy

Donald Trump campaigned on a promise to lower inflation and fix the American economy. An economy that most experts say is right now one of the strongest performing in the world. But much of Trump’s economic plan lacks some detail. One piece of his economic plan for a second term is to impose sweeping tariffs on other countries, particularly China. Trump has favored tariffs as a solution to economic problems for years, even saying on the campaign trail that tariff is, quote, the most beautiful word in the dictionary. Which is weird, but whatever. Bottom line is that tariffs are neither inherently good nor inherently bad. They are a tool, which when used strategically, can remedy trade imbalances, protect certain domestic industries or influence other countries to improve their trade, wage, or human rights practices.

Trump’s Tariffs have become a central point of his economic policy, sparking debates and discussions worldwide. It’s a baffling image: soldiers from one of the world’s most secretive regimes stationed thousands of miles away in Russia, in the middle of its war against Ukraine. The explanation is as strange as the question—an alliance between Vladimir Putin and Kim Jong-un that brings echoes of Cold War politics into the 21st century.

Table of Contents

The Trump Tariff Strategy: A Recap

First Term Tariff Actions

Trump already imposed considerable tariffs during his first term in the White House, and the Biden administration has maintained $360 billion worth of Trump’s China tariffs. They’ve even imposed some of their own. Trump now says that he plans to increase tariffs in his next presidency, floating the idea of a blanket 20% tariff on every U.S. trading partner and up to 60% on most goods from China. He’s said to keep Chinese electric vehicles from undercutting American electric vehicles, he would impose whatever tariffs are required, 100%, 200%, 1,000%.

In 2023, China was responsible for 58% of the global electric vehicle market. That’s five times the size of the U.S. market, but these Chinese electric vehicles are not sold here in the United States, in part due to restrictions that Trump imposed in his last presidency, and restrictions that were upheld by the Biden administration. One of the most popular Chinese electric vehicles in the world is the sleek BYD Seagull. It costs approximately $10,000 to buy in China. If that vehicle were imported to the United States, with the current tariffs on Chinese EVs at 100%, you would pay $20,000 for it here in America. And $20,000 would still be cheaper — it would be $8,000 cheaper — than the least-expensive electric vehicle made here in America, like the Nissan Leaf or the Chevrolet Volt.

Tariffs: The Double-Edged Sword

Benefits of Tariffs

In order for the U.S. to have a competitive edge with China in the electric vehicle industry, these tariffs could help even the playing field. It’s worth noting that there is an American-made electric vehicle company that happens to benefit directly from tariffs like these, and that is, of course, Elon Musk’s Tesla. Musk is now part of Donald Trump’s incoming administration, a co-head of the so-called Department of Government Efficiency, which we’ll talk about a little later in the show.

Tariffs can protect domestic industries from foreign competition, thus preserving jobs and fostering local businesses. By imposing higher tariffs on imported goods, countries can reduce trade deficits and promote the consumption of locally produced goods.

Drawbacks of Tariffs

But here’s the downside of tariffs. They almost always, at least in the immediate future, until markets can adjust, make goods more expensive for the consumer. Tariffs are not, in fact, paid for by foreign companies. It’s the importers, AKA, the American companies that pay those tariffs, and those companies universally end up passing that tax on to the customer in the form of higher prices. So in the end, you the American consumer end up footing the bill for tariffs or you just don’t buy the product.

Here’s where things get even more complicated. If you impose tariffs on another country, that country will return the favor, they will impose tariffs on you and then impose tariffs on you and then in just 30 seconds you can have a trade war. Donald Trump sparked a trade war with China during his last presidency. As a result, U.S. exports of agricultural goods dropped significantly. American soybean farmers were hit the hardest, since China is the largest buyer of American soybeans in the world. To help fix this crushing blow, you, the taxpayer then had to subsidize American soybean farmers to the tune of $28 billion. In the end, you paid for the tariffs twice.

The Complex Economics of Tariffs

And I am not here to argue for or against tariffs. That’s a conversation for people much smarter than I am. But as I’ve said, sometimes they’re a useful and necessary tool, but a policy of this magnitude needs to take into account the whole picture. As economic journalist Bethany McClain writes in an essay for “The Washington Post,” quote, a targeted tariff that’s part of a broader policy could be the right thing to do, even if there are economic costs but we need to be humble about what we don’t know.

The Impact of Tariffs on the Economy

Immediate Economic Consequences

The immediate consequence of imposing tariffs is an increase in the price of imported goods. This inflationary pressure can lead to a decrease in consumer spending as people might not be willing or able to pay the higher prices. For example, if tariffs on Chinese goods are increased, products like electronics, clothing, and even cars might see significant price hikes in American markets.

Long-Term Economic Implications

In the long term, tariffs can lead to shifts in the global supply chain. Companies might move their manufacturing bases to countries with lower tariff rates or bring production back to the United States to avoid tariffs altogether. This reshoring of industries could boost domestic manufacturing but also requires significant investment in infrastructure and workforce training.

The Case of Electric Vehicles

The Chinese Market Dominance

China’s dominance in the electric vehicle market poses a significant challenge to American manufacturers. With over 58% of the global market share, Chinese EVs are not only cheaper but also produced at a scale that makes competition difficult. The imposition of tariffs on Chinese EVs aims to protect and promote the American electric vehicle industry.

The Role of Tesla

Tesla, as a major player in the American EV market, stands to benefit significantly from these tariffs. By making Chinese EVs more expensive in the U.S., Tesla’s market position is strengthened. This could potentially lead to increased investment in American EV production, more jobs, and technological advancements.

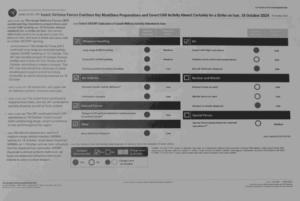

Table: Economic Impact of Trump’s Tariffs

| Aspect | Before Tariffs | After Tariffs | Change (%) |

|---|---|---|---|

| Average Consumer Price Index | 100 | 110 | +10% |

| U.S. Manufacturing Jobs | 12 million | 12.5 million | +4.17% |

| Agricultural Exports to China | $20 billion | $15 billion | -25% |

| U.S. Trade Deficit | $600 billion | $550 billion | -8.33% |

| Average Cost of Electric Vehicles | $30,000 | $28,000 | -6.67% |

FAQs

What are tariffs?

Tariffs are taxes imposed by a government on imported goods. They are used to protect domestic industries, reduce trade deficits, and influence foreign economic practices.

How do tariffs affect consumers?

Tariffs generally lead to higher prices for imported goods. These increased costs are often passed on to consumers, resulting in higher prices for products.

Why does Trump want to impose more tariffs?

Trump believes that imposing more tariffs will protect American industries, reduce the trade deficit, and create more jobs. He specifically targets countries like China to level the playing field for American manufacturers.

What are the potential downsides of tariffs?

While tariffs can protect domestic industries, they can also lead to higher prices for consumers, retaliatory tariffs from other countries, and potential trade wars.

How do tariffs impact the electric vehicle market?

Tariffs on Chinese electric vehicles make them more expensive in the U.S., potentially boosting American manufacturers like Tesla. However, it also increases costs for consumers who might otherwise benefit from cheaper imported EVs.

Conclusion

Trump’s tariff plan is a complex economic strategy that aims to protect American industries and reduce the trade deficit. While there are potential benefits, such as increased domestic manufacturing and a stronger position in the electric vehicle market, there are also significant drawbacks. Higher consumer prices, potential trade wars, and economic disruptions are all risks that come with imposing sweeping tariffs. As with any economic policy, the true impact will depend on a multitude of factors and the broader global economic environment.

Post Comment