Gold’s Mysterious Surge: What’s Fueling the Rally and How to Navigate It

The gleam of gold is casting a spell on investors once again. At a time when the U.S. economy is performing admirably, with low interest rates and a booming stock market, gold prices are skyrocketing to historic highs. What’s driving this seemingly paradoxical rally, and why are both new and seasoned investors diving headfirst into gold?

The Enigma of Gold’s Rise

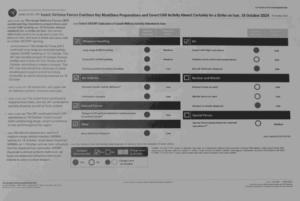

A glance at the gold price chart reveals peaks that typically align with periods of economic weakness and recessions. Traditionally, gold has been a safe haven during economic downturns, low interest rates, and plummeting stock markets. The Dow’s historic drop of 1,190 points, for instance, saw a corresponding rise in gold prices. Yet, the current scenario is different. The economy is strong, but gold prices are soaring. So, what’s behind this surge?

The Investment Shift: ETFs to Physical Gold

Two main avenues exist for investing in gold: ETFs (Exchange-Traded Funds) and physical gold. ETFs offer accessibility akin to buying stocks, without the hassle of storage and security concerns. However, a noticeable shift is occurring. Investors are selling off ETFs and flocking to physical gold—bars, coins, and jewelry.

This pivot towards physical gold began with central banks accumulating gold bars. Countries like China and Turkey, wary of potential asset freezes similar to those imposed on Russia, are diversifying their reserves by stocking up on gold. This trend intensified following the Ukraine-Russia War, doubling central bank gold purchases as a safeguard against geopolitical risks.

Central Banks and Global Events

The U.S. and its allies froze Russian assets during the conflict, heightening fears among nations like China and Turkey about their own reserves. Holding significant dollar-based assets like U.S. treasuries, these countries turned to gold, immune to the control of any single nation.

Gold’s intrinsic properties—its rarity and indestructibility—make it an attractive asset. Unlike fiat currencies, gold isn’t governed by a central authority. Its value is inherent, stemming from its limited supply. If all the gold ever mined were gathered, it would fit into a building roughly seven stories high and 5,000 square feet in area.

Rising Retail Interest

As central banks bolstered their gold reserves, individual investors followed suit, particularly in China. Over the past four years, retail investors in China have outpaced those in other countries in gold purchases. This trend is partly driven by younger generations, skeptical of traditional financial assets and seeking tangible, secure investments. Small gold items, like gold beans and balls, have become popular among these new investors.

A Global Trend

The allure of gold isn’t confined to China. Globally, the demand for gold is on the rise. A Gallup poll in 2023 revealed that Americans now view gold as a superior long-term investment compared to stocks. Retail giant Costco’s decision to sell gold bars online and in-store has also contributed to the buzz. The bars, priced at approximately $2,000 each, consistently sell out, reflecting the growing interest among everyday consumers.

The Psychological Factor

Why is gold so appealing during these times? Analysts suggest that while the current economy might be stable, concerns about its future are driving people to gold. Recent global events like the COVID-19 pandemic, the Ukraine-Russia conflict, the Middle East tensions, soaring government debt, and widespread political discord create an atmosphere of uncertainty. Gold offers a sense of security—a tangible asset that holds value irrespective of the financial climate.

Chinese Market Dynamics

In China, the stock market crash and real estate turmoil have further fueled the demand for gold. Traditionally, Chinese investors preferred property as a means of storing wealth. However, with the real estate market’s collapse, gold has emerged as a reliable alternative.

What Lies Ahead for Investors?

Investing in gold is not without risks. Its price can fluctuate based on market sentiment. However, the underlying factors driving the current rally—geopolitical uncertainties, economic concerns, and a shift in investment preferences—suggest that gold might remain a strong investment. Analysts are largely optimistic about its sustained value.

In conclusion, gold’s mysterious surge amidst a thriving economy is a testament to its enduring allure. As global uncertainties persist, gold remains a beacon of stability for investors seeking to safeguard their wealth. Whether through ETFs or physical gold, understanding the factors driving this trend can help investors navigate this golden opportunity.

FAQs

Q: Why is gold considered a safe haven during economic downturns? A: Gold is valued for its intrinsic properties, such as rarity and indestructibility, making it a reliable store of value when fiat currencies and other assets face instability.

Q: How do central bank purchases influence gold prices? A: Central banks buying gold increases demand, thereby driving up prices. Their purchases signal confidence in gold’s stability, encouraging other investors to follow suit.

Q: Is physical gold better than ETFs for investment? A: Physical gold provides tangible security and isn’t subject to the same market dynamics as ETFs. However, ETFs offer ease of trading and eliminate storage concerns. The choice depends on individual investment goals and risk tolerance.

Q: How has global political unrest affected gold prices? A: Events like the Ukraine-Russia conflict and Middle East tensions create uncertainty, prompting investors to seek refuge in gold. Such geopolitical risks often lead to increased gold purchases, driving up prices.

Q: Can gold prices drop despite current trends? A: Yes, gold prices are influenced by market sentiment and can fluctuate. While current trends support high prices, changes in economic conditions or investor behavior could lead to declines.

Post Comment